Cryptocurrency is more than just a speculative asset or a medium for transactions—it’s also a powerful tool for generating passive income. Whether you’re a seasoned crypto enthusiast or just getting started, there are various methods you can use to make your crypto work for you. Here’s an overview of the most popular ways to earn passive income with cryptocurrency, along with their pros, cons, and efficiency levels.

There are some ways to make passive money through cryptocurrencies

1. Staking

2. Yield Farming

3. Crypto Lending

4. Liquidity Pools

5. Masternodes

6. Dividend-Paying Tokens

7. Cloud Mining

8. NFT Royalties

9. Crypto Savings Accounts

People Also Like This:

Let’s discuss each point step by step with pros, cons, and efficiency

1. Staking:

Staking involves locking up a certain amount of cryptocurrency to support the operations of a blockchain network, specifically those using a Proof of Stake (PoS) consensus mechanism. In return, stakers receive rewards for their contribution to the network.

For Step By Step Staking Click Here

Pros of Staking:

- Relatively low risk compared to other methods.

- Regular and predictable rewards.

- Supports network security and operations.

Cons of staking:

- Requires a significant initial investment.

- Some platforms lock your funds for a fixed period.

- Returns can fluctuate based on network performance and token prices.

Efficiency of staking:

Moderate to high, depending on the network and staking conditions.

2. Yield Farming:

Yield farming involves lending or staking your crypto assets to earn interest or rewards in the form of additional tokens. This is typically done within decentralized finance (DeFi) platforms.

Pros of Yield Farming:

- High potential returns.

- Flexibility to switch between platforms to maximize yields.

Cons of Yield Farming:

- High risk due to volatile markets and potential smart contract vulnerabilities.

- Managing multiple platforms and assets can be complex.

- Risk of impermanent loss.

Efficiency of Yeld Farming:

High, but highly variable depending on market conditions.

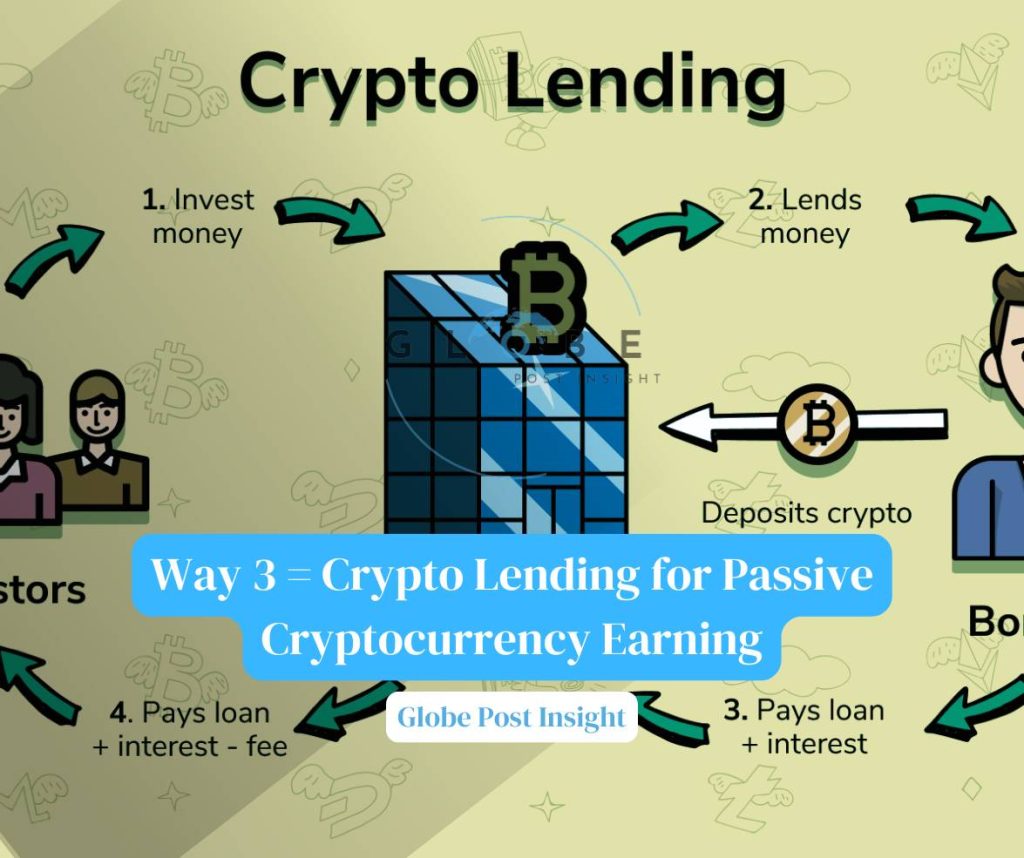

3. Crypto Lending:

Crypto lending platforms allow you to lend your assets to borrowers in exchange for interest payments. This is a straightforward way to earn a stable return on your crypto holdings.

Pros of Crypto Lending:

- Stable and predictable income.

- No need to sell assets to earn returns.

Cons of Crypto Lending:

- Risk of borrower default.

- Platform risk if the lending platform faces liquidity issues or insolvency.

Efficiency of Crypto Lending:

High, with consistent returns as long as the platform remains solvent.

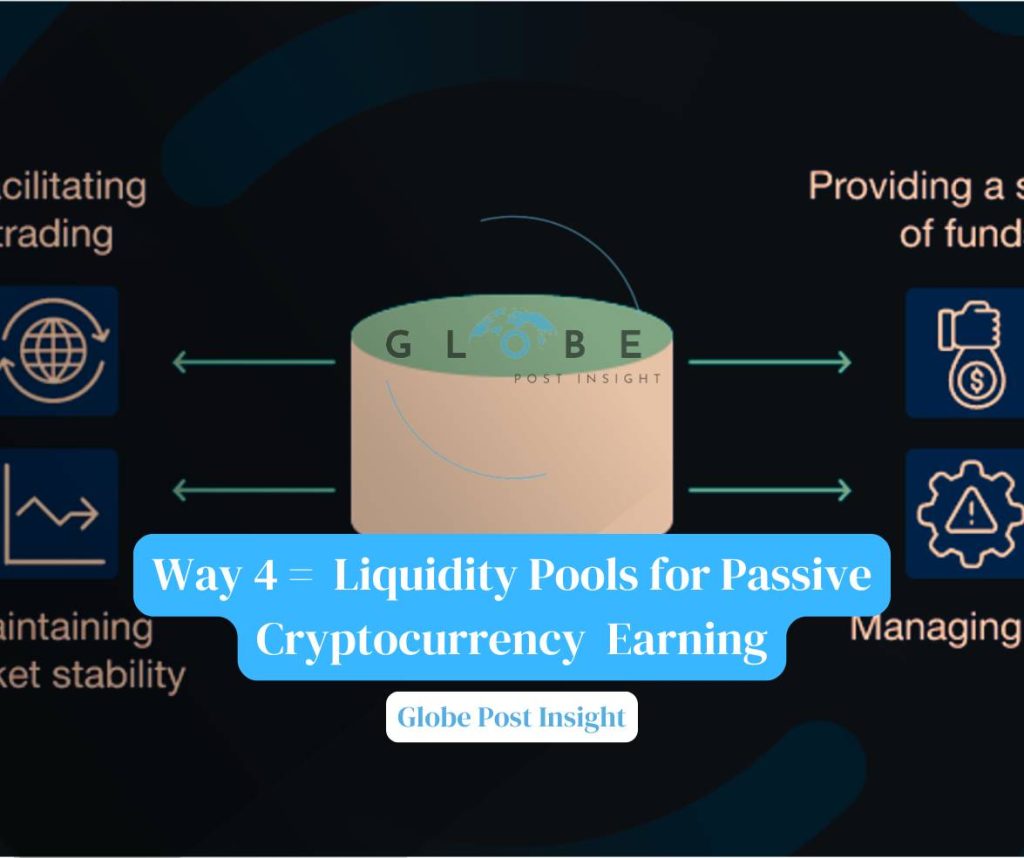

4. Liquidity Pools:

Liquidity pools are a core feature of decentralized exchanges (DEXs). By providing liquidity (depositing crypto into a pool), you earn fees from trades that take place within that pool.

Pros of Liquidity Pools:

- Earn trading fees along with rewards.

- Supports the decentralized finance ecosystem.

Cons of Liquidity Pools:

- Risk of impermanent loss (when the value of your assets changes unfavorably).

- Requires ongoing management and monitoring.

Efficiency of Liquidity Pools:

Moderate to high, depending on the volume of trades and performance of the pool.

5. Masternodes:

Running a masternode involves operating a full node of a blockchain network. In return, you receive rewards for helping secure the network and participate in its governance.

Pros of Masternodes:

- High rewards for running a node.

- Contributes to network stability and governance.

Cons of Masternodes:

- Requires a significant initial investment.

- Requires technical knowledge and ongoing maintenance.

Efficiency of Masternodes:

High, but only if you can meet the high entry requirements and handle the technicalities.

6. Dividend-Paying Tokens:

Some blockchain projects distribute regular dividends to token holders in the form of additional tokens. These dividends are usually tied to the success of the project.

Pros of Dividend-Paying Tokens:

- Regular dividends.

- Participation in the success of a project.

Cons of Dividend-Paying Tokens:

- Dividend amounts can vary based on project performance.

- Risk of project failure or token devaluation.

Efficiency of Dividend-Paying Tokens:

Moderate, depending on the success and growth of the underlying project.

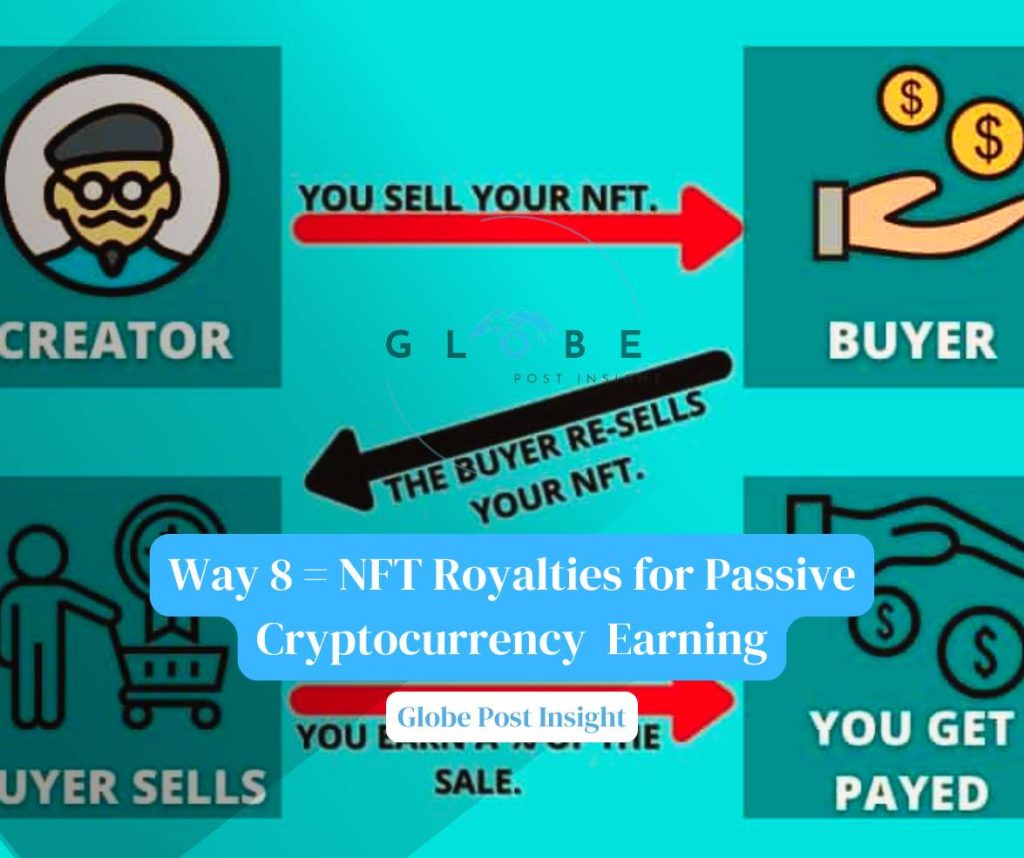

7. NFT Royalties:

Non-fungible tokens (NFTs) offer a unique way to earn passive income through royalties. Whenever an NFT you’ve created is resold on a secondary market, you receive a percentage of the sale.

Pros of NFT Royalties:

- Continuous income from secondary sales.

- Supports the creative economy, particularly artists and creators.

Cons of NFT Royalties:

- Highly speculative and depends on the popularity of the NFT.

- The NFT market can be volatile and illiquid.

Efficiency of NFT Royalties:

Variable, based on demand and resale activity in the NFT marketplace.

8. Cloud Mining:

Cloud mining allows you to rent mining hardware without owning or maintaining the equipment yourself. You earn a portion of the mining rewards, depending on your share of the cloud mining contract.

Pros Cloud Mining:

- No need to purchase or maintain hardware.

- Potential for steady income.

Cons of Cloud Mining:

- High risk of scams or unreliable providers.

- Lower profitability due to service fees and reduced mining rewards over time.

Efficiency of Cloud Mining:

Low to moderate, depending on mining conditions and the reliability of the service provider.

9. Crypto Savings Accounts:

Crypto savings accounts allow you to deposit your crypto and earn interest, much like a traditional savings account. Platforms like Celsius and BlockFi offer this service.

Pros of Crypto Savings Accounts:

- Predictable interest earnings.

- Simple, user-friendly process.

Cons of Crypto Savings Accounts:

- Interest rates may be lower compared to other crypto income methods.

- Platform risk if the company faces liquidity issues or gets hacked.

Efficiency of Crypto Savings Accounts:

High, with consistent and predictable returns.

Summary of passive income from cryptocurrency:

Earning passive income with cryptocurrency has become a viable strategy for many investors.

Each method offers its own set of risks and rewards, so it’s essential to choose one that aligns with your financial goals and risk tolerance.

Whether you’re staking your coins, providing liquidity, or running a masternode, the opportunities to generate passive income in the crypto world are abundant—if you approach them wisely.

For More Understanding, You Can visit www.blockpit.io