The cryptocurrency market has become a playground for aggressive investors, thriving on its volatility. Cryptocurrencies like Dogecoin (DOGE) can generate extraordinary returns, but their long-term sustainability remains uncertain. Let’s dive deeper into whether Dogecoin has the potential to make you a millionaire by 2025.

Why Dogecoin?

Dogecoin, created in 2013 as a joke, became the pioneer of meme coins—cryptocurrencies inspired by internet humor. Unlike mainstream cryptocurrencies, meme coins generally lack significant real-world utility, which makes them risky but capable of delivering explosive returns in bullish markets.

Key Historical Performance

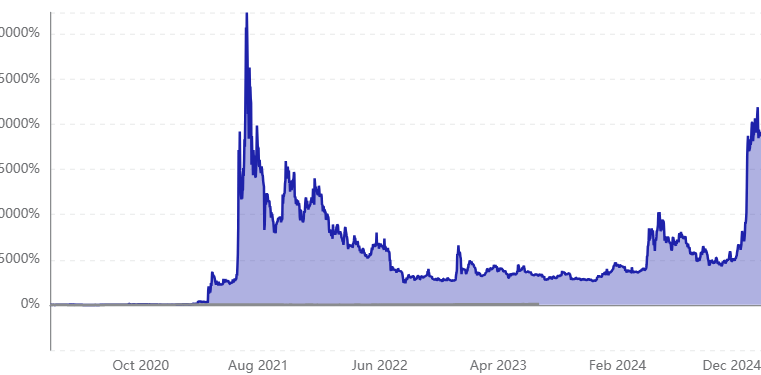

- Dogecoin remained under the radar until 2021 when Elon Musk’s tweets propelled it into the spotlight.

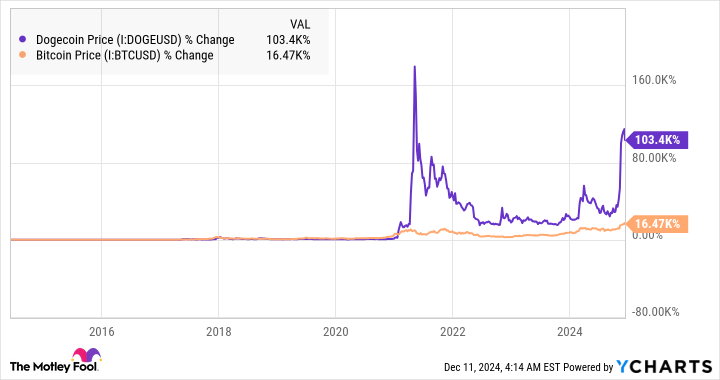

- Since its inception, Dogecoin has gained an astounding 103,400%, surpassing Bitcoin’s 16,470% growth during the same timeframe.

- However, Dogecoin remains volatile, with prices down 45% from its all-time high of $0.7376 in May 2021.

What’s Behind the Latest Rally?

Dogecoin’s recent surge is once again tied to Elon Musk, a vocal supporter of the cryptocurrency. Here are some factors driving the rally:

Elon Musk’s Influence

- Musk’s backing on social media, particularly X (formerly Twitter), has consistently fueled Dogecoin’s price rallies.

- The formation of the Department of Government Efficiency (DOGE) under the new Trump administration echoes Dogecoin’s name, stoking excitement among investors.

A Favorable Regulatory Environment

- The upcoming Trump administration is expected to adopt a pro-crypto stance, potentially easing regulations.

- The resignation of current SEC Chairman Gary Gensler, who led a crackdown on cryptocurrency platforms, could signal a shift toward more crypto-friendly policies.

- The new SEC head nominee, Paul Atkins, is anticipated to pursue a less aggressive approach, making cryptocurrencies more accessible and appealing to institutional investors.

Related Article:

Challenges for Dogecoin’s Long-Term Growth

While the short-term outlook for Dogecoin appears bright, several challenges could hinder its long-term potential:

Inflationary Design

- Dogecoin generates 5 billion new coins annually, which increases the total supply (currently at 147 billion coins).

- This inflationary model enhances liquidity but reduces its appeal as a long-term investment.

Speculation Over Fundamentals

- Unlike Bitcoin, Dogecoin lacks a robust value proposition beyond its popularity, making it more susceptible to speculative trading cycles.

Is Dogecoin a Buy Right Now?

Reasons to Consider Dogecoin

- Short-Term Growth Potential: A favorable regulatory environment could boost market sentiment and attract institutional investors.

- Community Support: Dogecoin benefits from an active and loyal community that continues to champion its adoption.

Reasons to Be Cautious

- Volatility Risks: Dogecoin’s price is heavily influenced by hype and external factors, which could lead to sudden drops.

- Limited Use Cases: Without real-world utility or technological innovation, Dogecoin’s long-term sustainability remains in question.

Expert Advice for Investors

Before investing in Dogecoin, consider broader opportunities in the market. For instance, The Motley Fool Stock Advisor has identified 10 promising stocks with potential for long-term growth. Investing wisely in stocks like Nvidia, which returned 822x its original value since 2005, could be a more reliable path to wealth than speculative cryptocurrencies.

Conclusion: Should You Bet on Dogecoin?

Dogecoin has made millionaires in the past, but whether it can do so again in 2025 depends on its ability to sustain the current momentum and overcome its challenges. If you’re considering investing, be aware of the risks and don’t allocate more than you can afford to lose. Diversifying your investments across traditional assets and cryptocurrencies might be the best strategy to achieve long-term financial goals.

Disclaimer: This is not financial advice so invest at your own risk or talk to your financial advisor.